Call me blinded by incandescent rage, but my other senses are in tip top shape and I detect the sharp tang of the Naderians in the current raucous incoherence of the PUMAs (Party Unity My Ass; a small step down in class and a considerable step down in patriotism from SEIU (Suck Eggs, Iococca. USA!)). As before, the commitment to empty principle over the well-being of actual, living human beings threatens to land the country in the Republican lap. McLoin's lap. As noted earlier in this blog, better is better than worse. Almost by definition, in fact. Holding out for the perfect and uncompromised manifestion of one's principles is a long wait in a democracy.

Although, in fairness to the dewey-eyed Naderites, they voted their (I would argue, unconscionable) conscience; the current crop of PUMAs don't seem limited to Nader-style rigidity. Some of them are apparently just Republicans with a strong sense of gender loyalty:

"The Hillary Democrats are moving on---to John McCain. You see, this is what the Obama coalition of rich white liberals and racist blacks doesn't understand: the Hillary Democrats don't subscribe to the crackpot social causes of the new left; they never did. They're FDR Democrats, not LBJ Democrats. They have no interest in placating racist blacks, illegal immigrants, Islamists, gay activists, environuts, etc. They're in it for good jobs, for fair taxation of the wealthy, for healthcare, and for proper regulation of industry."

Passing lightly over what fair taxation for the wealthy means here, I struggled to split the hair between African-Americans' support of an African-American being racism, while women's support of a woman is simply a laudable effort to shatter the glass ceiling. The way I was able to do it was to look closely economic and sociological data to reassure myself that there are no barriers to upward movement for African-Americans. This comforting conclusion, coupled with a reminder that historically African-Americans have never really faced the kind of systematic discrimination women now face (women only make 77 cents on the male dollar! Never in history did African-Americans face that kind of inequality!) and a close look at my income bracket, finally allowed me to wipe the tears of frustration from my cheeks and vote Republican.

It's about time I was fairly taxed. And that goes double (metaphorically, of course) for my capital gains.

Wednesday, August 27, 2008

Wednesday, August 13, 2008

In Case Anyone Didn't Catch It

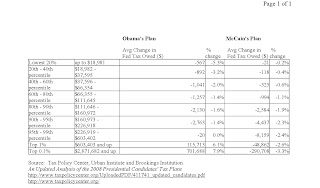

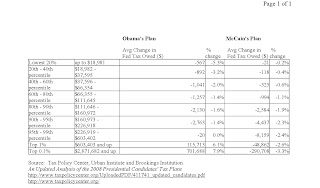

Perhaps you all have caught The Loin's new advertising campaign. Its theme is: "Obama is an oblivious rich elitist (though of course he has a mere fraction of The Loin's wealth) who wants to raise taxes on hardworking middle-income Americans." Obviously, this is not true.

Estimated Effect of Obama and The Loin's Tax Plans by Income Cohort

Original source here.

Estimated Effect of Obama and The Loin's Tax Plans by Income Cohort

Original source here.

Tuesday, August 12, 2008

Startling New Poll

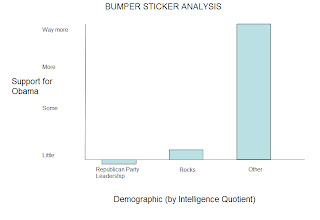

Let me first start by saying this post is only marginally related to socialism, in that it demonstrates compelling reasons for forcing all citizens to pay into the kitty in order to pay for accurate and sustainable poll sources.

That said, I recently returned from a road trip with my two dogs to the east coast, and the 14-16 hours in the car each way enabled me to conduct, by far, the most extensive poll of bumper stickers east of the Mississippi. Although I would be happy to detail my methodology, I know that Ryan simply prefers to publish nice graphs, and so I will do just that.

Before viewing, know that my sample size was 12, which is obviously significant at all levels. Also, the first column is negative because I saw one sticker that said "Republicans for Voldemort" which, as we all know, is McCain's middle name (though he spells it SVoldemort).

So, without further adieu (clik for larger view):

In all seriousness, I saw no McCain stickers all across the states of Indiana, Ohio, Pennsylvania, New York, New Jersey and Hogwarts (except for the one). It certainly doesn't actually indicate anything about the race, but I thought it was interesting.

Once again, apologies to Ryan for hijacking his blog for utterly useless political commentary. I promise to return to socialism soon.

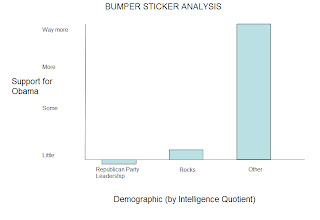

That said, I recently returned from a road trip with my two dogs to the east coast, and the 14-16 hours in the car each way enabled me to conduct, by far, the most extensive poll of bumper stickers east of the Mississippi. Although I would be happy to detail my methodology, I know that Ryan simply prefers to publish nice graphs, and so I will do just that.

Before viewing, know that my sample size was 12, which is obviously significant at all levels. Also, the first column is negative because I saw one sticker that said "Republicans for Voldemort" which, as we all know, is McCain's middle name (though he spells it SVoldemort).

So, without further adieu (clik for larger view):

In all seriousness, I saw no McCain stickers all across the states of Indiana, Ohio, Pennsylvania, New York, New Jersey and Hogwarts (except for the one). It certainly doesn't actually indicate anything about the race, but I thought it was interesting.

Once again, apologies to Ryan for hijacking his blog for utterly useless political commentary. I promise to return to socialism soon.

Saturday, August 2, 2008

For All of the Howling, U.S. Taxes Not Overwhelmingly Progressive

As an Obama presidency looms, we will all have to suffer through an onslaught of crooning about how an Obama administration would somehow tax the rich into virtual servitude. If only we could be so lucky.

Before we get too excited about what may happen in the future, it's good to get an idea of where we stand now. To get a baseline estimate of the present overall distribution of the country's tax burden, I found data on the percentage of income paid by each quintile (as well as the 80th - 94th percentile, the 95th-99th percentile, and the top 1%) in all Federal (i.e., the income tax, corporate tax, estate and gift tax, payroll taxes, and all other miscellaneous taxes) and all state and local taxes. You will notice that while the Federal tax system is quite progressive (though inadequately so, especially as to the very very rich), state and local taxes are, on balance, quite regressive. The result is that the U.S. tax regime, taken in its entirety, is progressive but not overwhelmingly so. Does it seem right that households making between $37,258 and $65,634 a year should pay an average of 25% of their income in all taxes while households making $601,907 and up should pay an average of 35%? That's an awfully modest increase in percentage tax burden for a ~10-fold or potentially much, much greater increase in income (to get an idea of the spread at the very top, hedge fund manager John Paulson made $3.7 billion in 2007).

I could not obtain state and local tax data for the top 0.1% (which starts at a household income of about $2.9 million a year), but the Federal tax burden of the top 0.1% (31.6%) shows that the percentage of income paid in Federal taxes increases very slowly as taxpayers' income increases dramatically. I'd be willing to wager serious bones that the overall percentage tax burden begins to decline as we move up the income ladder into the absurdly wealthy (i.e., households that make hundres of millions of dollars a year and therefore that will pay a negligible percentage of their income in state and local taxes and will receive most of their income in the form of capital gains taxed at the lower 15% rate under the Federal income tax code). I am not alone (read this and this) in this view.

Total Taxes Paid as a % of Income by Income Group

Am I wrong that this (i.e., the fact that the Federal tax code appears to have the potential to be somewhat fair while the state and local tax regimes do not) is another argument in favor of abolishing federalism? Just to speculate here, might it be the case that jurisdictional competition between states to attract higher income residents (or, more maliciously, to chase away lower income residents) is driving down the relative state and local tax burden on the well off? Higher earning New Yorkmen can move to Jersey or Connecticut or Chicagokaaners can move to Indiana to try to lower their state or local tax burden. But it's a little harder to leave the country 'cause your miffed at the tax burden (besides, where would you go? Seoul? Guadalajara?). I really struggle to see the benefits of our federalist system.

Note: The Federal data is for 2008, while the state and local data is for 2002. There probably are some minor comparability issues, but I seriously doubt that anything has changed very dramatically since 2002, or that there is any massive methodological difference between the two reports significant enough to alter the overall picture.

Also Note: The Federal tax burden percentage for the 80th - 94th percentile and the state and local tax burden percentage for the top 20% are estimates based on the percentages given for the most similar available income groups.

Before we get too excited about what may happen in the future, it's good to get an idea of where we stand now. To get a baseline estimate of the present overall distribution of the country's tax burden, I found data on the percentage of income paid by each quintile (as well as the 80th - 94th percentile, the 95th-99th percentile, and the top 1%) in all Federal (i.e., the income tax, corporate tax, estate and gift tax, payroll taxes, and all other miscellaneous taxes) and all state and local taxes. You will notice that while the Federal tax system is quite progressive (though inadequately so, especially as to the very very rich), state and local taxes are, on balance, quite regressive. The result is that the U.S. tax regime, taken in its entirety, is progressive but not overwhelmingly so. Does it seem right that households making between $37,258 and $65,634 a year should pay an average of 25% of their income in all taxes while households making $601,907 and up should pay an average of 35%? That's an awfully modest increase in percentage tax burden for a ~10-fold or potentially much, much greater increase in income (to get an idea of the spread at the very top, hedge fund manager John Paulson made $3.7 billion in 2007).

I could not obtain state and local tax data for the top 0.1% (which starts at a household income of about $2.9 million a year), but the Federal tax burden of the top 0.1% (31.6%) shows that the percentage of income paid in Federal taxes increases very slowly as taxpayers' income increases dramatically. I'd be willing to wager serious bones that the overall percentage tax burden begins to decline as we move up the income ladder into the absurdly wealthy (i.e., households that make hundres of millions of dollars a year and therefore that will pay a negligible percentage of their income in state and local taxes and will receive most of their income in the form of capital gains taxed at the lower 15% rate under the Federal income tax code). I am not alone (read this and this) in this view.

Total Taxes Paid as a % of Income by Income Group

Am I wrong that this (i.e., the fact that the Federal tax code appears to have the potential to be somewhat fair while the state and local tax regimes do not) is another argument in favor of abolishing federalism? Just to speculate here, might it be the case that jurisdictional competition between states to attract higher income residents (or, more maliciously, to chase away lower income residents) is driving down the relative state and local tax burden on the well off? Higher earning New Yorkmen can move to Jersey or Connecticut or Chicagokaaners can move to Indiana to try to lower their state or local tax burden. But it's a little harder to leave the country 'cause your miffed at the tax burden (besides, where would you go? Seoul? Guadalajara?). I really struggle to see the benefits of our federalist system.

Note: The Federal data is for 2008, while the state and local data is for 2002. There probably are some minor comparability issues, but I seriously doubt that anything has changed very dramatically since 2002, or that there is any massive methodological difference between the two reports significant enough to alter the overall picture.

Also Note: The Federal tax burden percentage for the 80th - 94th percentile and the state and local tax burden percentage for the top 20% are estimates based on the percentages given for the most similar available income groups.

Friday, July 25, 2008

So, About This Minimum Wage Thing...

As you may be aware, the Federal minimum wage was scheduled to increase to $6.55 yesterday. Today I had a Facebox e-debate of sorts which I think has helped me refine my position on the issue of income support for poor workers. I am very interested in other people’s take on my position on the issue.

Standard neoclassical economic theory tells us that a legally mandated minimum wage, if it is above the market clearing wage, will reduce employment, especially for the most marginally employable workers. The microeconomic rationale for this is pretty straightforward; if you forbid employers to pay any wage under $X/hr., they will fire or not hire employees who are worth any amount less than $X/hr. So the guy who is worth only $7/hr. loses (or never gets) his job when the minimum wage is increased to $7.50/hr. As always, the standard economic theory is plausible. But, also as always, it must be empirically supported to form the basis of informed policy-making. The magical curves and lines don't always get it right.

When I took a labor economics class in college, this study was relatively new and represented kind of a coup d'etat. The Krueger and Card study compared the effect of an increase in the minimum wage on employment in the fast food industry in one state with the level of employment in the fast food industry in an adjacent state that did not increase its minimum wage. Surprisingly, the study found that employment had actually slightly increased (relatively) in the state that had increased its minimum wage. Naturally, this sparked a great gnashing of teeth and back-and-forth debate within the economics profession

So today, a right-wing Facebox-friend of mine posted something to the effect that any increase in the minimum wage is an "inane" policy. In response, I drew his attention to the Krueger and Card study. He, in turn, posted a link to this study, which provides a pretty comprehensive survey of the minimum wage literature. The study found that almost 2/3 of the studies it surveyed, and 85% of the studies it found "most credible," showed a negative, "but not always statistically significant" effect of minimum wage laws on the number of people employed and/or hours of employment. The majority of the studies appear to have found that a 10% increase in the minimum wage leads to a roughly 1% to 3% reduction in the employment of low-skill workers, with significantly stronger negative effects on teenagers and young adults and much weaker negative effects on adults 25 and older.

The study appears pretty thorough and I think I buy its conclusion – i.e., there’s generally a small, negative effect of a minimum wage increase on the employment of low-skill workers. But it's important to bear these results in perspective. A 1% to 3% reduction in low-income employment is not the end of the world, particularly if we had an adequate social welfare state to provide for the subsistence of the unlucky 1%-3% (which, unfortunately we don't, but many other countries do). But it is a significant downside effect that we should take into account when thinking about income support issues. Interestingly, left-leaning economist Paul Krugman appears to share this concern ("...the centrist view is probably that minimum wages 'do,' in fact, reduce employment, but that the effects are small and swamped by other forces.").

I have proposed a fairly radical solution to all of these employment and income support issues (see #'s 1 and 6). But it's probably safe to assume that that's not going to happen any time soon. In the meantime, I think it's helpful to look at the issue the way right-of-center Harvard economist Gregory Mankiw does: as a tax on employers of low skill workers which directly funds a subsidy to low skill workers. Looking at it this way raises the obvious question - why should the employers of low skill workers bear the whole burden of this subsidy? Surely, income support of poor workers is more of a general social responsibility than the exclusive responsibility of poor workers' private employers, just as medical insurance and care is a general public and social responsibility (even if, in this country, it is an abdicated one) and should not be regarded as the particular responsibility of workers’ employers. Therefore it would be fairer and more efficient to simply increase taxes (disproportionately on high earners and very disproportionately on very high earners, of course), and then to use the proceeds to significantly increase the Earned Income Tax Credit (the EITC, or "negative income tax") for poor workers.

With respect to the relative efficiency of using a negative income tax policy instead of a minimum wage policy, consider this CBO report which found that a hypothetical increase in the minimum wage in 2005 from $5.15 to $7.25/hr. would have given an additional $11 billion overall to workers making somewhere between $5.15 - $7.24/hr. (of which, startlingly, only 18% were actually members of poor families in 2005, at least according to the notoriously low Federal poverty guidelines), only $1.6 billion of which (or about 15%) would have gone to workers in poor families. On the other hand, an increase in the EITC with the same overall income effect as the minimum wage increase would have cost the Federal government a total of $2.4 billion, $1.4 billion of which would have gone to poor families. If these estimates are reliable, the minimum wage is a very blunt instrument for supporting the incomes of poor workers.

So it seems to me getting rid of the minimum wage and drastically increasing the EITC (along with providing payments at least on a bi-weekly basis and not in one lump sum at the end of the year so the whole thing doesn't end up going to H&R Block or payday lenders) is the way to go, at least before we can push for anything more ambitious. The effect of this would be to allow employers to hire whomever they want at whatever price the employee will agree to, but to use the additional public revenues raised by a big progressive tax increase to bring everyone up to (at least) the poverty level. This way we fund the income support subsidy through the proceeds of a broad based progressive tax system rather than specifically punishing employers who happen to operate in low-skill industries by forcing them to pay for the whole burden, and a much higher percentage of the proceeds will go to workers who are actually in low income families. And of course then we would avoid the whole negative employment effect of the minimum wage (especially since, as we know, increases in tax rates generally have negligible effects on labor supply).

The bottom line for me is that the income support of the poor (ideally to the point where they are no longer “poor”) is a fundamental social responsibility, but that this responsibility would be fulfilled in a much fairer and more effective manner if the government (relying on high, progressive tax revenues) were to provide direct subsidies to poor workers rather than forcing private employers to serve as surrogate welfare agencies.

Standard neoclassical economic theory tells us that a legally mandated minimum wage, if it is above the market clearing wage, will reduce employment, especially for the most marginally employable workers. The microeconomic rationale for this is pretty straightforward; if you forbid employers to pay any wage under $X/hr., they will fire or not hire employees who are worth any amount less than $X/hr. So the guy who is worth only $7/hr. loses (or never gets) his job when the minimum wage is increased to $7.50/hr. As always, the standard economic theory is plausible. But, also as always, it must be empirically supported to form the basis of informed policy-making. The magical curves and lines don't always get it right.

When I took a labor economics class in college, this study was relatively new and represented kind of a coup d'etat. The Krueger and Card study compared the effect of an increase in the minimum wage on employment in the fast food industry in one state with the level of employment in the fast food industry in an adjacent state that did not increase its minimum wage. Surprisingly, the study found that employment had actually slightly increased (relatively) in the state that had increased its minimum wage. Naturally, this sparked a great gnashing of teeth and back-and-forth debate within the economics profession

So today, a right-wing Facebox-friend of mine posted something to the effect that any increase in the minimum wage is an "inane" policy. In response, I drew his attention to the Krueger and Card study. He, in turn, posted a link to this study, which provides a pretty comprehensive survey of the minimum wage literature. The study found that almost 2/3 of the studies it surveyed, and 85% of the studies it found "most credible," showed a negative, "but not always statistically significant" effect of minimum wage laws on the number of people employed and/or hours of employment. The majority of the studies appear to have found that a 10% increase in the minimum wage leads to a roughly 1% to 3% reduction in the employment of low-skill workers, with significantly stronger negative effects on teenagers and young adults and much weaker negative effects on adults 25 and older.

The study appears pretty thorough and I think I buy its conclusion – i.e., there’s generally a small, negative effect of a minimum wage increase on the employment of low-skill workers. But it's important to bear these results in perspective. A 1% to 3% reduction in low-income employment is not the end of the world, particularly if we had an adequate social welfare state to provide for the subsistence of the unlucky 1%-3% (which, unfortunately we don't, but many other countries do). But it is a significant downside effect that we should take into account when thinking about income support issues. Interestingly, left-leaning economist Paul Krugman appears to share this concern ("...the centrist view is probably that minimum wages 'do,' in fact, reduce employment, but that the effects are small and swamped by other forces.").

I have proposed a fairly radical solution to all of these employment and income support issues (see #'s 1 and 6). But it's probably safe to assume that that's not going to happen any time soon. In the meantime, I think it's helpful to look at the issue the way right-of-center Harvard economist Gregory Mankiw does: as a tax on employers of low skill workers which directly funds a subsidy to low skill workers. Looking at it this way raises the obvious question - why should the employers of low skill workers bear the whole burden of this subsidy? Surely, income support of poor workers is more of a general social responsibility than the exclusive responsibility of poor workers' private employers, just as medical insurance and care is a general public and social responsibility (even if, in this country, it is an abdicated one) and should not be regarded as the particular responsibility of workers’ employers. Therefore it would be fairer and more efficient to simply increase taxes (disproportionately on high earners and very disproportionately on very high earners, of course), and then to use the proceeds to significantly increase the Earned Income Tax Credit (the EITC, or "negative income tax") for poor workers.

With respect to the relative efficiency of using a negative income tax policy instead of a minimum wage policy, consider this CBO report which found that a hypothetical increase in the minimum wage in 2005 from $5.15 to $7.25/hr. would have given an additional $11 billion overall to workers making somewhere between $5.15 - $7.24/hr. (of which, startlingly, only 18% were actually members of poor families in 2005, at least according to the notoriously low Federal poverty guidelines), only $1.6 billion of which (or about 15%) would have gone to workers in poor families. On the other hand, an increase in the EITC with the same overall income effect as the minimum wage increase would have cost the Federal government a total of $2.4 billion, $1.4 billion of which would have gone to poor families. If these estimates are reliable, the minimum wage is a very blunt instrument for supporting the incomes of poor workers.

So it seems to me getting rid of the minimum wage and drastically increasing the EITC (along with providing payments at least on a bi-weekly basis and not in one lump sum at the end of the year so the whole thing doesn't end up going to H&R Block or payday lenders) is the way to go, at least before we can push for anything more ambitious. The effect of this would be to allow employers to hire whomever they want at whatever price the employee will agree to, but to use the additional public revenues raised by a big progressive tax increase to bring everyone up to (at least) the poverty level. This way we fund the income support subsidy through the proceeds of a broad based progressive tax system rather than specifically punishing employers who happen to operate in low-skill industries by forcing them to pay for the whole burden, and a much higher percentage of the proceeds will go to workers who are actually in low income families. And of course then we would avoid the whole negative employment effect of the minimum wage (especially since, as we know, increases in tax rates generally have negligible effects on labor supply).

The bottom line for me is that the income support of the poor (ideally to the point where they are no longer “poor”) is a fundamental social responsibility, but that this responsibility would be fulfilled in a much fairer and more effective manner if the government (relying on high, progressive tax revenues) were to provide direct subsidies to poor workers rather than forcing private employers to serve as surrogate welfare agencies.

Monday, July 21, 2008

Social Democracy and Political and Civil Liberty

"That government is best which governs least”

-Henry David Thoreau

There is a long thread in American political thought that associates "big government" (presumably a government financed by relatively high taxes and which controls certain markets and extensively regulates most others) with a decrease in the civil liberties (also known as "negative rights") enjoyed by its people. Though always influential, the theory has enjoyed a renaissance since the beginning of the Reagan era. But, beyond the simple “power will be abused” mantra, does the “small government” crowd have anything harder to point to (besides, obviously, comparisons to dictatorial communist regimes like North Korea and Cuba which no one advocates anymore)? To put the question more concretely, are decreases in the economic and regulatory prominence of the government associated with decreases in civil and political liberties in OECD countries?

The SDI index that I have proposed in earlier posts corresponds well with what most people would call “big government” – high and progressive taxes, high social, health, and education expenditures, strong organized labor and legislative labor protections (although organized labor is not itself a feature of the state, its strength often depends on state support and enforcement of the laws of union organization and collective bargaining). So we can try to answer this question by seeing if there is a correlation between SDI and various indicia of civil liberties (or the lack thereof).

In an attempt to provide a single figure to represent the degree of political and civil freedom enjoyed by the citizens of a particular country, I have calculated an “Authoritarian Regime Index” (ARI). The figure is comprised of scaled scores of the following:

30% - Incarceration Rate

30% - Law and Order Expenditures as a % of GDP

15% - Degree of Restriction of the Press calculated from Reporters Without Borders Ratings

25% - (-1) * The Economist Intelligence Unit's Index of Democracy

Note: Complete data was only available for:

Austria

Belgium

Czech Republic

Denmark

Finland

France

Germany

Hungary

Italy

Netherlands

Norway

Poland

Portugal

Slovakia

Spain

Sweden

UK

US

Therefore, only these countries are used in the analysis. I do not think this sample set presents any obvious problems in terms of comparability nor do I think it leaves out any country which would significantly tip the scales in one direction or the other. If anyone thinks otherwise, please let me know.

I have given the Economist's democracy index only a 25% weight because its criteria may overlap somewhat with the other three variables I use. Of course, there is certainly an amount of arbitrariness in this and all indices. But since I do not have the appropriate raw data available myself, I am giving both the Economist (an economically center-right publication) and Reporters Without Borders (more left-leaning, I think) the benefit of the doubt. And on the whole I think my weighting represents a fair balance of the criteria relevant to the level of political and civil "freedom" the people of a country enjoy.

ARI - 18 Country Sample (higher = authoritarian)

So, on to the big question. What is the relationship between SDI and ARI? If the R is positive, then "bigger" government is correlated with a decrease in civil and political liberty, as the "small government" people would predict. If it is negative, "big government" is instead correlated with greater civil and political liberty, and the "small government" crowd has a real empirical mystery to account for.

SDI and ARI

R = -0.788 (where 0.5 is the cutoff for a "strong" correlation)

Surprise, surprise. Using the countries I looked at, those countries with "bigger" government actually tended very strongly to be "freer," at least as I defined "free." As always, I would be very interested to hear any critiques or objections to my methods. But with a result this strong, it is virtually unimaginable that any suggested change would materially alter this clearly observable relationship.

-Henry David Thoreau

There is a long thread in American political thought that associates "big government" (presumably a government financed by relatively high taxes and which controls certain markets and extensively regulates most others) with a decrease in the civil liberties (also known as "negative rights") enjoyed by its people. Though always influential, the theory has enjoyed a renaissance since the beginning of the Reagan era. But, beyond the simple “power will be abused” mantra, does the “small government” crowd have anything harder to point to (besides, obviously, comparisons to dictatorial communist regimes like North Korea and Cuba which no one advocates anymore)? To put the question more concretely, are decreases in the economic and regulatory prominence of the government associated with decreases in civil and political liberties in OECD countries?

The SDI index that I have proposed in earlier posts corresponds well with what most people would call “big government” – high and progressive taxes, high social, health, and education expenditures, strong organized labor and legislative labor protections (although organized labor is not itself a feature of the state, its strength often depends on state support and enforcement of the laws of union organization and collective bargaining). So we can try to answer this question by seeing if there is a correlation between SDI and various indicia of civil liberties (or the lack thereof).

In an attempt to provide a single figure to represent the degree of political and civil freedom enjoyed by the citizens of a particular country, I have calculated an “Authoritarian Regime Index” (ARI). The figure is comprised of scaled scores of the following:

30% - Incarceration Rate

30% - Law and Order Expenditures as a % of GDP

15% - Degree of Restriction of the Press calculated from Reporters Without Borders Ratings

25% - (-1) * The Economist Intelligence Unit's Index of Democracy

Note: Complete data was only available for:

Austria

Belgium

Czech Republic

Denmark

Finland

France

Germany

Hungary

Italy

Netherlands

Norway

Poland

Portugal

Slovakia

Spain

Sweden

UK

US

Therefore, only these countries are used in the analysis. I do not think this sample set presents any obvious problems in terms of comparability nor do I think it leaves out any country which would significantly tip the scales in one direction or the other. If anyone thinks otherwise, please let me know.

I have given the Economist's democracy index only a 25% weight because its criteria may overlap somewhat with the other three variables I use. Of course, there is certainly an amount of arbitrariness in this and all indices. But since I do not have the appropriate raw data available myself, I am giving both the Economist (an economically center-right publication) and Reporters Without Borders (more left-leaning, I think) the benefit of the doubt. And on the whole I think my weighting represents a fair balance of the criteria relevant to the level of political and civil "freedom" the people of a country enjoy.

ARI - 18 Country Sample (higher = authoritarian)

So, on to the big question. What is the relationship between SDI and ARI? If the R is positive, then "bigger" government is correlated with a decrease in civil and political liberty, as the "small government" people would predict. If it is negative, "big government" is instead correlated with greater civil and political liberty, and the "small government" crowd has a real empirical mystery to account for.

SDI and ARI

R = -0.788 (where 0.5 is the cutoff for a "strong" correlation)

Surprise, surprise. Using the countries I looked at, those countries with "bigger" government actually tended very strongly to be "freer," at least as I defined "free." As always, I would be very interested to hear any critiques or objections to my methods. But with a result this strong, it is virtually unimaginable that any suggested change would materially alter this clearly observable relationship.

Wednesday, July 16, 2008

Complements of Bruce Lee

A friend of mine from law school posted this link on Facebox (sorry if you've already seen it on there). The graphs are not merely nice. They are delicious.

Labels:

2008 presidential election,

Economic Growth,

Feast

Subscribe to:

Posts (Atom)